Kim Wilson, MPP Staff Writer, Brief Policy Perspectives

Since Sept. 2019, financial markets reporting has covered turmoil in the repo market. Not to be confused with cars being repossessed for nonpayment, the repo market refers to exchanges of reserves that fund day-to-day financial operations. Short for repurchase agreement, a “repo” is a short-term, collateralized loan that banks and other financial entities frequently utilize to settle daily transactions and ensure compliance with post-financial-crisis reserve requirements. In mid-Sept. 2019, overnight repo rates surged from around two percent to nearly ten percent due to a shortage of reserves available for repo borrowing. In response, the Federal Reserve implemented emergency repo operations for the first time since the Great Recession that have continued to date, sparking concerns over broader financial implications.

Why Do We Need a Repo Market?

Banks, hedge funds, and other financial firms trade reserves daily to settle their customers’ transactions. For example, on a given day, if Bank A’s customers write a total of $1 million worth of checks to recipients who bank with Bank B, Bank A must send over $1 million to Bank B at close of business to settle the check transactions. Banks must have sufficient reserves, which one can think of as cash on hand, to settle their daily transactions while maintaining a minimum reserve balance that is required by the Fed to prevent bank insolvency. Banks typically maintain minimal levels of cash reserves because the opportunity cost of holding funds is high. Reserves earn minimal interest, so by keeping more of them on hand, banks lose returns that they could have earned by investing those funds elsewhere. Banks earn higher returns investing more of their excess assets into higher-yield vehicles, keeping their reserve balances low, and borrowing through overnight repo transactions to settle transactions at close of business. However, some banks choose to hold excess reserves, above the Fed’s required minimum and can lend those funds to other banks via the repo market.

How Do Repo Transactions Work?

Repurchase agreements function similarly to short-term car title loans for consumers, except at a far lower interest rate. Banks in need of quick cash will temporarily sell their illiquid assets, i.e., securities like U.S. Treasury bonds, for cash from entities that have excess reserves, such as money market mutual funds, or other banks. The firm needing cash will sign a repo agreement to buy back its securities at a premium within a short window, typically the next day. The repo market allows banks to access quick cash for a small surcharge, and it enables entities with extra funds to turn a profit with low risk. The scale of the repo market is enormous: between $2 to 4 trillion of repurchase agreements are traded every day to ensure that banks and other entities can settle their daily transactions. Given the significance of the market, Wall Street and policymakers alike are concerned with the Fed’s unprecedented, ongoing actions to prop up the repo market that began in September.

What Happened in September?

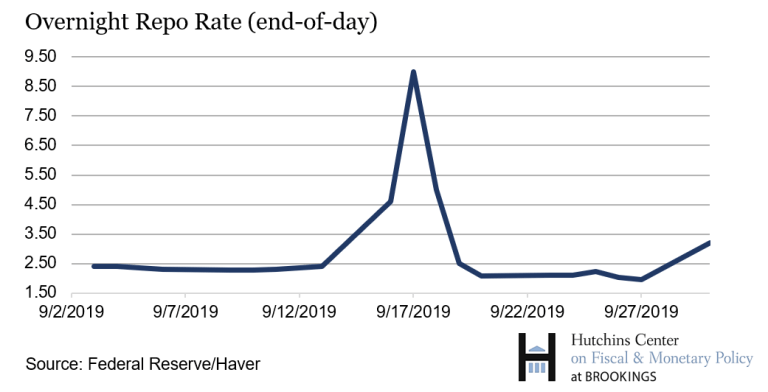

In mid-Sept. of last year, the supply of reserves available for repo trading was insufficient to meet demand by banks and other firms needing cash to meet their daily obligations. A shortage of funds for repo trading caused the repo rate, or the price of repo transactions, to skyrocket. The repo crisis caused another key metric, the price of Federal Reserve-facilitated, unsecured interbank loans – also referred to as the federal funds rate – to tick up, which greatly concerned the Fed. The New York Fed suggested that two confounding factors led to the shortage: 1) the due date for quarterly corporate tax payments reduced excess bank reserves and 2) the settlement date for Treasury securities. In other words, money market mutual funds and other entities that typically have plenty of cash available for lending suddenly had other priorities for their excess cash and were therefore unable to lend it on the repo market. To mitigate the crisis and prevent insolvency, the Fed initiated backup repo operations for the first time since the 2008 financial crisis. The Fed’s repo operations remain in effect and will continue for the foreseeable future, especially considering market uncertainties due to the coronavirus.

The Fed’s Ongoing Repo Market Intervention

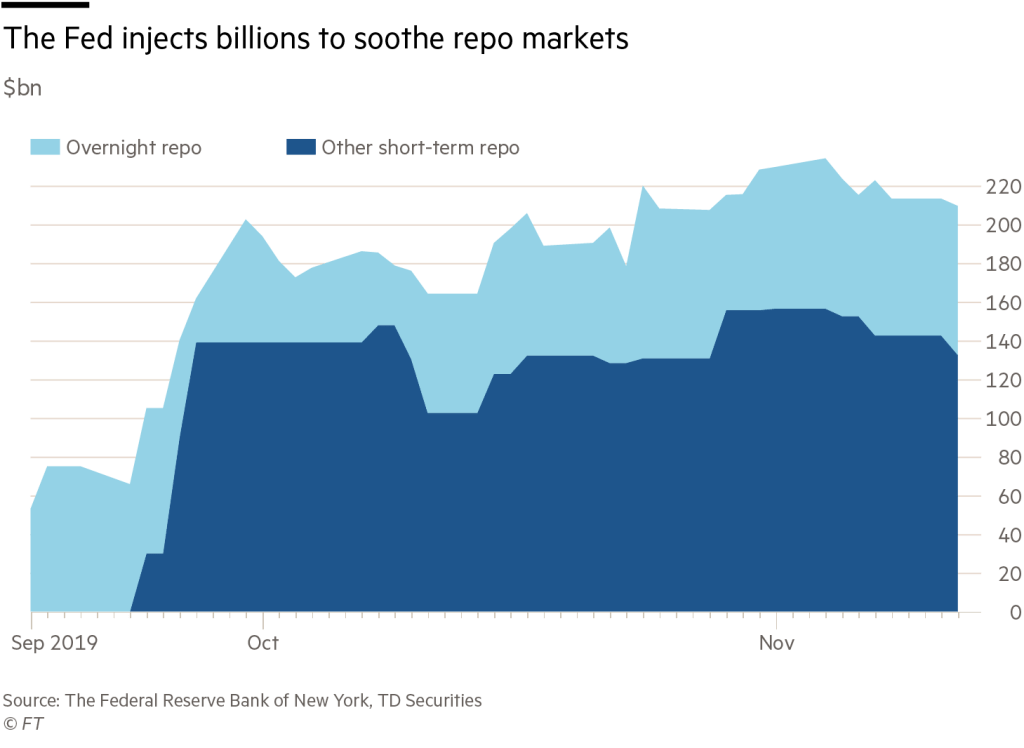

Following the Sept. market turmoil, the Fed initiated daily overnight repo operations to prevent the market from stalling again. The Fed also injected reserves into the financial system by purchasing short-term Treasury securities, indicating that the Fed’s winding down of post-financial-crisis interventions may have contributed to the repo crunch. The Fed’s support of the repo market is likely to continue amid growing concern over the coronavirus epidemic’s impact on the economy. Banks and other financial firms that typically lend out excess reserves on the repo market began restricting their repo activity as the epidemic worsened, driving up repo rates once again. In addition to continuing its repo operations and securities purchases, the Fed took emergency action to cut the federal funds rate by 0.5% – the first emergency rate cut since 2008 – a clear acknowledgment of economic uncertainty.

Potential Policy Solutions

While further action may be necessary as the coronavirus epidemic continues to impact markets, the Fed plans to maintain its backup repo operations until at least April 2020. The Fed’s Federal Open Market Committee (FOMC) that manages monetary policy is currently considering two policy solutions: continuing its current backup functions for an undetermined period of time or establishing a standing fixed-rate repo facility. A standing facility would assure market participants of the Fed’s intention to permanently back up the repo market, but this option is accompanied by the challenging task of setting an appropriate fixed price for repo services that encourages modest use by firms that need it. The FOMC is weighing the risks and benefits of both options while prioritizing the continuation of an ample reserves framework. Although experts do not contend that recent repo market turmoil is indicative of deeper vulnerabilities within the financial system, it is clear that the Fed’s continued supervision and support of repo functions are critical to maintaining market solvency.