Kim Wilson, MPP Staff Writer, Brief Policy Perspectives

Policymakers are considering alternatives to an expiring rule exemption intended to protect mortgage borrowers and prevent defaults. The Consumer Financial Protection Bureau (CFPB) established the qualified mortgage (QM) government-sponsored enterprise (GSE) patch to enable lending to creditworthy borrowers with debt-to-income (DTI) ratios above 43 percent. Proponents of the patch argue that it improves access to credit for lower-income households or for borrowers who cannot document all of their income in accordance with QM standards. Alternatively, opponents suggest that the GSE patch facilitates risky lending and contributes to excess demand in the housing market. Stakeholders are urging regulators to carefully consider the future of the GSE patch, given its implications for credit access and rising concerns over another recession.

Origins of Mortgage Lending Reforms

Subprime mortgage lending in the early-mid 2000s led to the greatest economic downturn in US history since World War II. Incentivized by high returns on mortgage-backed securities and collateralized debt obligations, lenders issued mortgages liberally and permitted or even encouraged uncreditworthy borrowers to take on more debt than they could afford to repay. Irresponsible mortgage issuance continued until the market crashed in Dec. 2007, kicking off a two-and-a-half-year recession. Home values dropped by nearly 30 percent from 2006 to 2009. Foreclosures reached an all-time high of nearly three million per year in 2009 and 2010.

Source: ATTOM Data Solutions

To resuscitate the failing economy and protect consumers from negligent lending activity, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (PL 111-203), signed into law on July 21, 2020. The Dodd-Frank Act implemented sweeping reforms to the financial ecosystem, including the creation of a Bureau of Consumer Financial Protection (CFPB) to oversee consumer protection issues. Dodd-Frank also ended unscrupulous mortgage lending by establishing ability-to-repay rules that requires lenders to document proof of income to ensure that borrowers are not overleveraged.

Ability-to-Repay and Qualified Mortgage Rule

In 2014, the CFPB implemented a rule on Ability-to-Repay (ATR) and qualified mortgage (QM) standards that requires “creditors to make a reasonable, good faith determination of a consumer’s ability to repay” non-commercial mortgage loans. The rule limits permissible fees and interest rates, prohibits certain types of loans such as those with balloon payments or terms longer than 30 years, and sets a maximum debt-to-income (DTI) ratio of 43 percent. The CFPB included a temporary exception to the 43-percent DTI cap for loans that are eligible for purchase by the government-sponsored enterprises (GSEs) Fannie Mae or Freddie Mac until GSE conservatorship ends.

Impact on Mortgage Lending

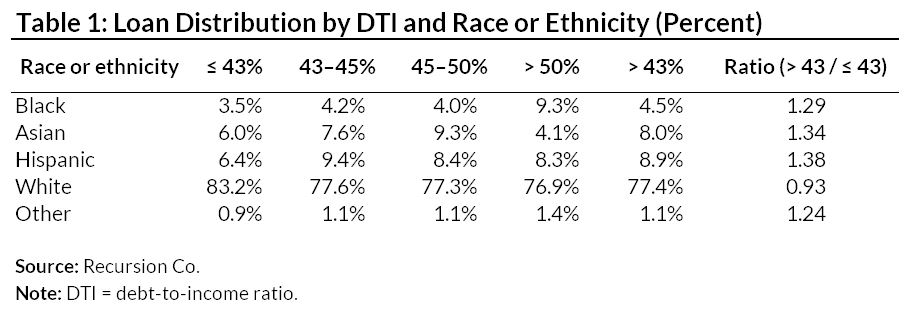

The GSE patch enabled nearly one in five loans issued between 2014 and 2018, totaling 3.3 million mortgages that otherwise would not have been approved. According to an analysis of Home Mortgage Disclosure Act (HMDA) data matched with GSE origination data, the proportion of borrowers that are African American, Asian, Hispanic, or low-income increases as DTI increases. The report indicates that these borrowers will be disproportionately harmed should the CFPB allow the GSE patch to expire with no replacement.

Patch the Patch or Change Course?

The President and CEO of the Mortgage Bankers Association, Bob Broeksmit, argued that the CFPB should provide a temporary GSE patch extension to prevent market disruption. The Independent Community Bankers Association also cited concerns with the expiring patch in their recent letter to the CFPB: “it is important to recognize that any changes that remove the Patch and/or modify QM/ATR will impact all mortgage loans originated, regardless if these loans are sold to GSEs.”

Edward Pinto, Director of the American Enterprise Institute Housing Center, disagreed, suggesting that the GSE patch is putting economic stability at risk by contributing to inflated home prices and increasing the population of overleveraged borrowers. The CATO Institute voiced similar concerns and noted that elimination of the GSE patch would reduce risk and promote private mortgage market competitiveness.

Acknowledging the potential need for a GSE patch alternative, Karan Kaul and Laurie Goodman of the Urban Institute suggested replacing the 43-percent DTI cap with a cap on the annual percentage rate (APR) assigned to the loan. Kaul and Goodman argue that APR provides a more holistic consideration of risk, as DTI is one of several inputs to APR pricing determinations. Their report notes that an APR alternative could incentivize lenders to offer lower APRs than they otherwise would have in order for loans to qualify.

Future of the Patch

In a July 2019 proposed rule, the CFPB announced its intention to let the patch expire by January 2021, suggesting that it is hampering private mortgage market competitiveness. The US Department of Treasury later suggested that the CFPB “avoid market disruption in connection with the expiration of the QM patch and the implementation of any amendments to the… [ATR] rule.” The CFPB is currently reviewing feedback submitted in response to the July 2019 notice and must develop a transition plan or approve an extension before the patch’s 2021 expiration date. Considering the devastation caused by unscrupulous mortgage lending just over a decade ago, as well as disparate impact concerns reported by the Urban Institute, the CFPB’s pending decision has significant implications for prospective homebuyers and overall economic stability.